Finance and Stock Data Scraping Services for Smarter Decisions

Gain a fresh perspective on market trends with our stock market data scraping services. Capture dynamic stock data to uncover secret patterns and maintain a competitive edge with real-time insights.

Notable Brands in the Industry Space

Power of Financial and Stock Data for Business

Finance and stock data scraping helps businesses track market movements, stock prices, trading volumes, company performance, financial news, and investment trends in real time. Gain accurate market intelligence, strengthen risk assessment, support investment research, and make informed financial decisions that improve forecasting, portfolio strategy, and long-term business growth.

Our Finance and Stock Data Scraping Services

We extract reliable financial and stock market data from trusted platforms, including prices, historical trends, company fundamentals, market news, and trading insights — helping businesses, analysts, and investors make smarter, data-driven financial decisions.

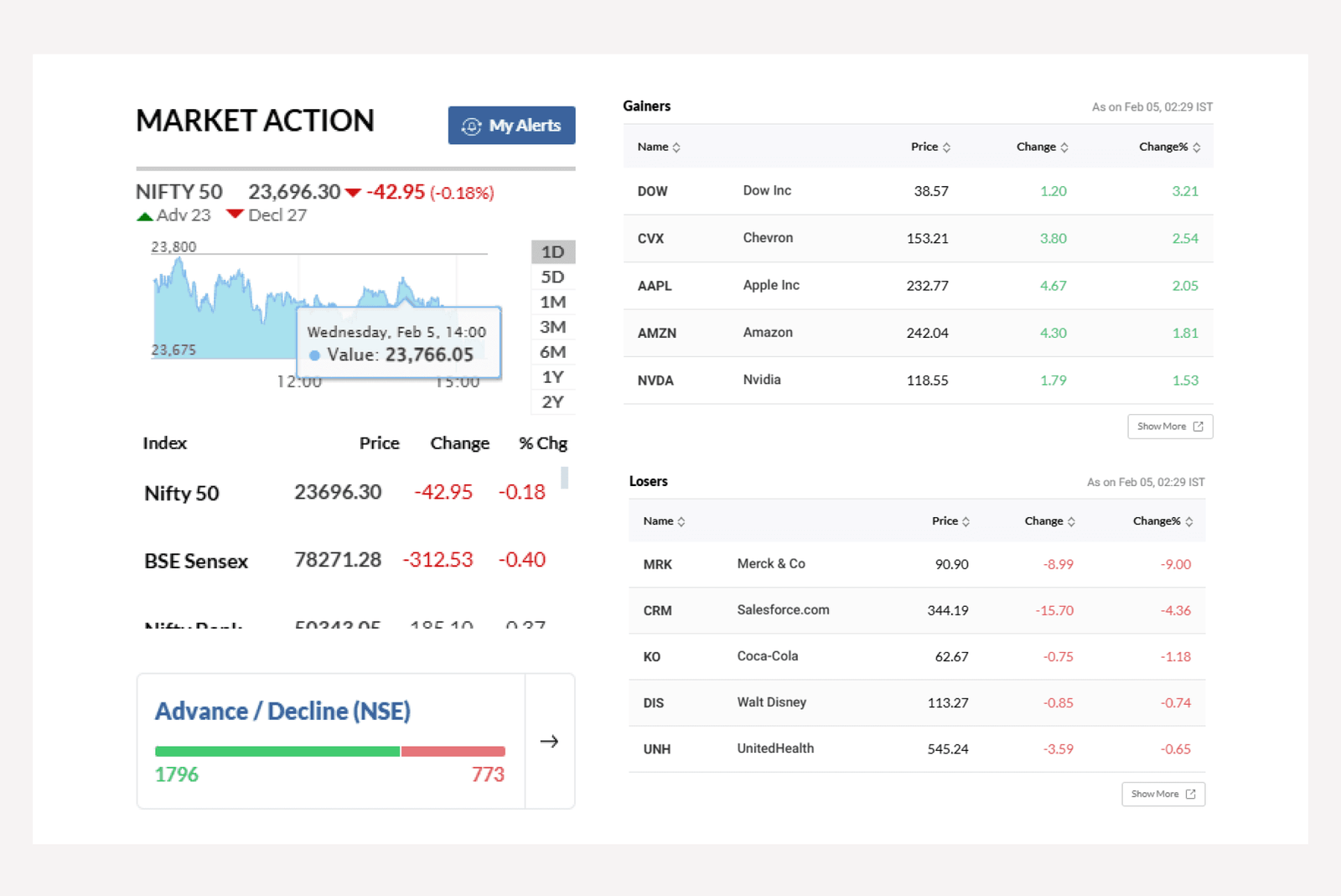

Real-Time Stock Price Data Scraping

Our real-time stock price data scraping service provides precise, up-to-date market insights to support smarter trading and investment decisions. We capture live stock movements, price fluctuations, historical patterns, volume shifts, and trend indicators as they occur across trusted financial platforms. This continuous flow of detailed market intelligence helps you stay informed, react quickly to market changes, and identify profitable opportunities with confidence. By accessing accurate, time-sensitive financial data, you can enhance trading strategies, improve risk assessment, and make data-driven decisions in dynamic market conditions. Our cutting-edge technology ensures every significant movement is monitored and transformed into actionable investment insights.

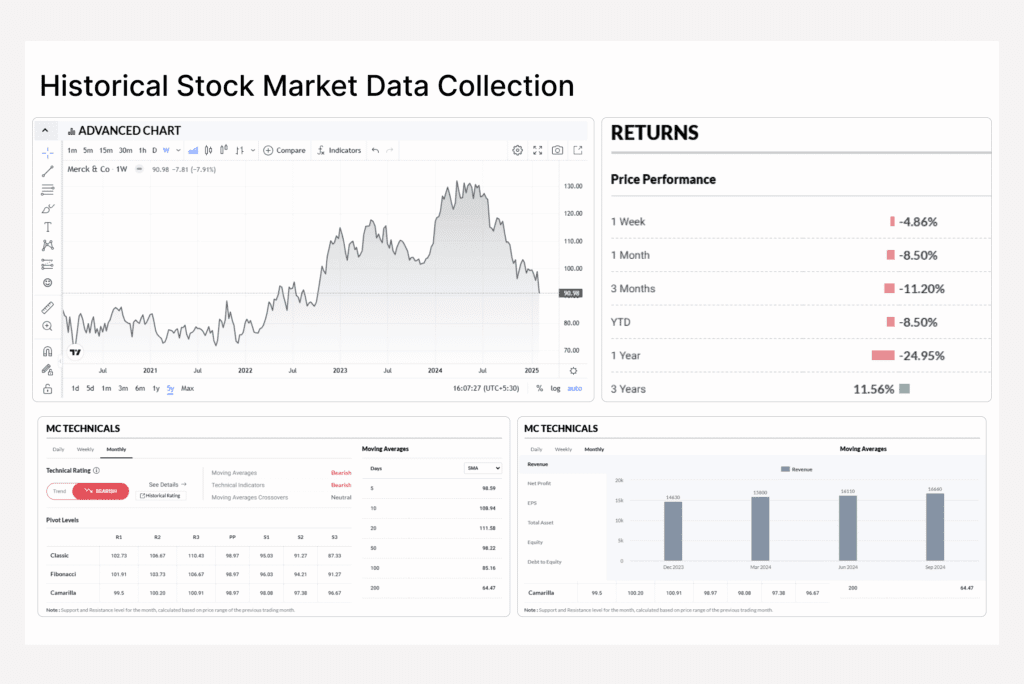

Historical Stock Market Data Collection

Our historical stock market data scraping service helps you explore past market activity with accuracy and depth. We collect comprehensive historical price records, trading volumes, performance charts, and long-term movement patterns across multiple financial sources. These insights enable you to identify recurring trends, analyze market behavior over different periods, and develop smarter, research-driven trading strategies. By studying previous highs, lows, and reaction cycles, you gain clearer visibility into risk factors and investment opportunities. With structured historical financial data at your fingertips, you can conduct meaningful analysis, support back-testing models, and make more informed decisions based on proven market patterns.

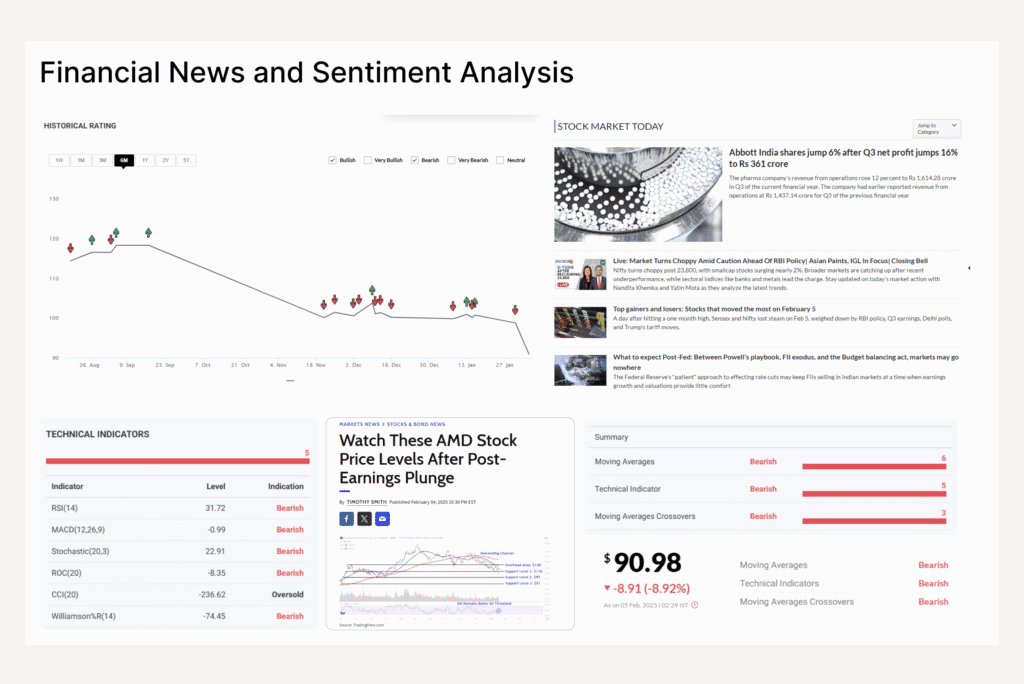

Financial News and Sentiment Analysis

Our market news and sentiment analysis scraping service helps you stay updated with the latest financial developments and investor emotions that influence market movement. We collect real-time news articles, analyst opinions, economic updates, and sentiment signals from trusted financial sources to reveal how markets react to key events. These insights allow you to understand positive, negative, and neutral sentiment trends, improving your ability to anticipate shifts and refine investment strategies. By combining financial data scraping with sentiment intelligence, you gain a deeper perspective on market behavior, reduce uncertainty, and make more informed, strategic investment decisions with confidence in changing market conditions.

Company Financial Reports Extraction

Our company financial reports data scraping service helps you access detailed, reliable insights into organizational performance and financial health. We extract structured information from balance sheets, income statements, annual reports, and financial disclosures to provide a clear view of revenue trends, profitability, liabilities, and growth indicators. These insights enable investors, analysts, and business leaders to evaluate stability, benchmark performance, and identify potential opportunities or risks. By transforming complex financial documents into actionable intelligence, you can make smarter strategic decisions, support valuation analysis, and strengthen investment research with confidence. Accurate financial data empowers you to understand companies more deeply and plan effectively.

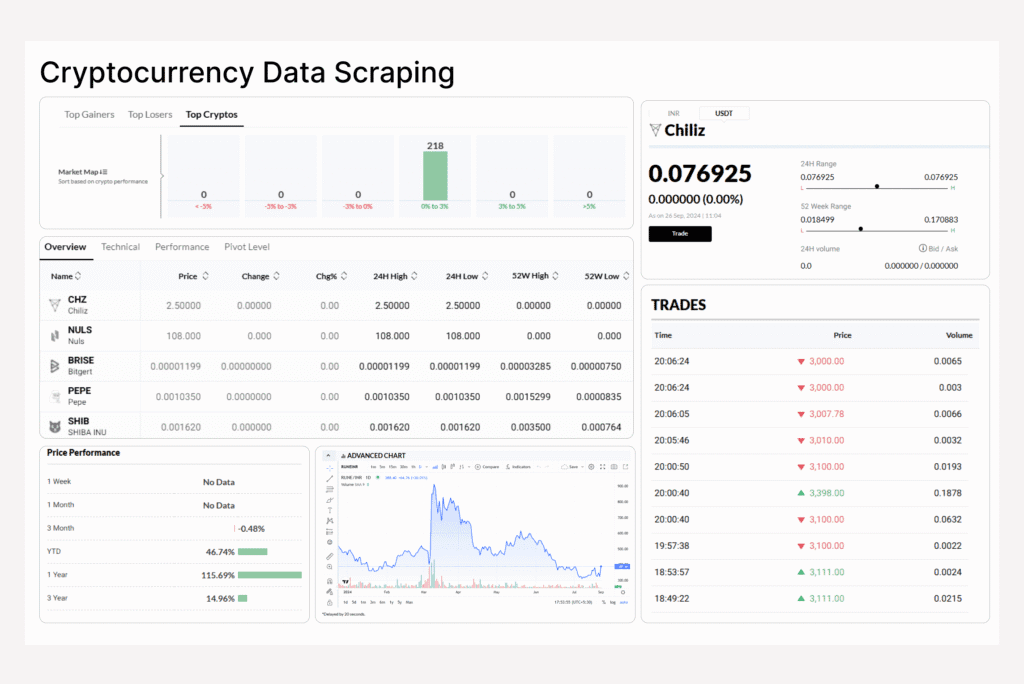

Cryptocurrency Data Scraping

Our cryptocurrency market data scraping service provides real-time insights into digital currency performance, helping you make smarter and more informed investment decisions. We collect accurate data on price movements, trading volumes, market trends, exchange activity, and token behavior across leading crypto platforms. These insights reveal fluctuations, emerging opportunities, and risk indicators within constantly changing crypto markets. By accessing structured and reliable crypto intelligence, you can analyze market patterns, refine trading strategies, and stay informed about shifting digital asset values. This data-driven visibility empowers investors, analysts, and fintech platforms to confidently navigate the evolving cryptocurrency landscape and capitalize on meaningful growth opportunities.

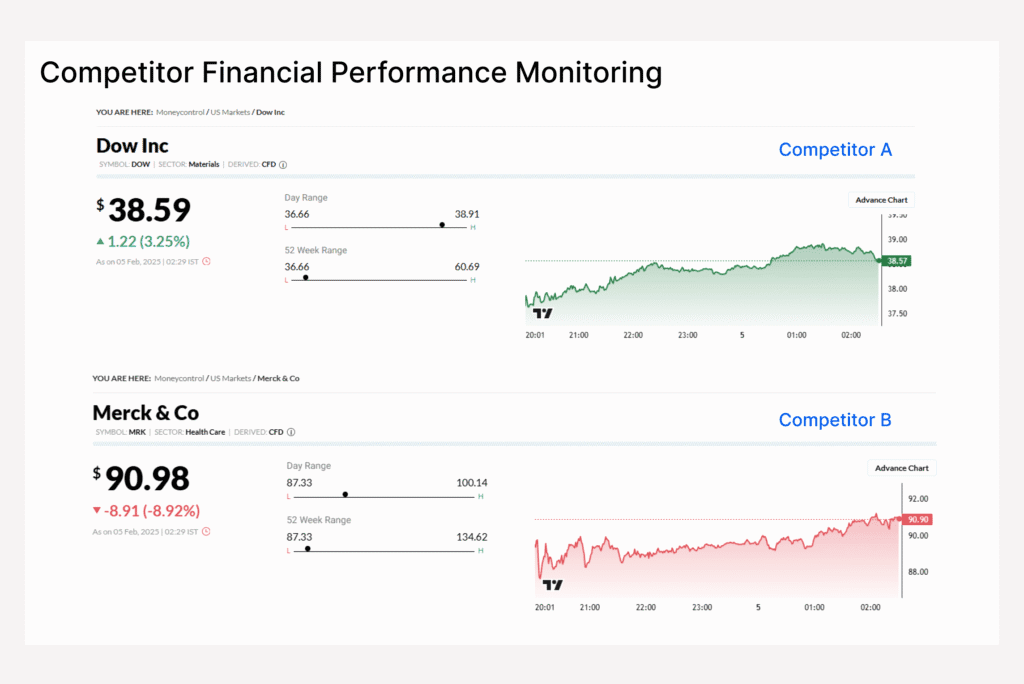

Competitor Financial Performance Monitoring

Our competitor financial performance monitoring service helps you precisely track the financial health, growth patterns, and market position of rival organizations. Using stock market and financial data scraping, we extract key metrics such as revenue trends, valuation movements, profitability indicators, investment activity, and market response to strategic changes. These insights provide real-time visibility into competitor strengths, vulnerabilities, and emerging opportunities within your industry. By analyzing financial patterns and performance shifts, you can refine business strategies, anticipate market developments, and make proactive, data-driven decisions. This strategic financial intelligence empowers you to stay competitive, strengthen positioning, and capitalize on new growth opportunities with confidence.

Our Web Scraping Service Process

Our web scraping process focuses on your goals, delivering clean, ready-to-use insights through a precise, secure workflow. Get reliable data that drives meaningful business results.

Goal Discovery

We understand your goals and identify valuable data sources that matter most.

01.

Smart Planning

We craft a custom scraping strategy tailored to your specific business needs.

02.

Data Extraction

Our advanced tools securely gather accurate, real-time data from multiple sources.

03.

Data Refinement

We clean, organize, and validate your data for clarity and easy usability.

04.

On-time Delivery

Receive your final dataset securely, in your preferred format and schedule.

05.

Case Study

Trusted by Clients Worldwide

Outstanding service! The team delivered accurate Amazon data much faster than expected, exceeding expectations impressively.

Frequently Asked Questions

Can you scrape data for specific companies or industry sectors?

Yes, we can scrape data on specific companies and sectors, including profiles, financial indicators, news, filings and market activity. You can target industries, indexes or individual organizations. Focused datasets support competitor research, benchmarking, investment analysis and trend monitoring, helping your team make informed, data-driven strategic and financial decisions for growth.

Which financial markets and platforms do you support for data scraping?

We scrape financial data from global stock exchanges, market portals and analytics platforms such as Yahoo Finance, Nasdaq, NYSE, London Stock Exchange and many regional markets. Our service collects prices, volumes, fundamentals, indices and corporate events across sources, giving you comprehensive market coverage for research, trading intelligence and performance monitoring.

How frequently can stock price data be updated?

Stock price data can be updated in line with your needs, ranging from near-real-time intervals to hourly, daily or custom schedules. Automated pipelines stream market changes, validate feeds and refresh records continuously. Flexible update options ensure you always receive current, trustworthy pricing insights for trading analysis, reporting and strategic decision-making.

How do you ensure the accuracy and timeliness of financial data?

We ensure accuracy and timeliness through multi-source validation, automated quality checks and continuous monitoring of market feeds. Our systems detect anomalies, synchronize timestamps, remove duplicates and verify key fields such as prices, volumes and symbols. Regular audits and controlled parsing deliver reliable, consistent financial datasets you can trust for analysis.

How can stock market data benefit my organization?

Stock market data helps your organization understand trends, benchmark competitors and support investment strategy. With insights on prices, volumes, sectors and corporate actions, you can evaluate opportunities, manage risk, forecast performance and refine research workflows. Data-driven intelligence strengthens decision-making across finance, strategy, analytics and leadership teams for measurable business impact.